3 Easy Facts About Offshore Company Management Shown

Wiki Article

The 6-Second Trick For Offshore Company Management

Table of ContentsOffshore Company Management - TruthsThe 8-Minute Rule for Offshore Company ManagementSome Known Facts About Offshore Company Management.Offshore Company Management Can Be Fun For Anyone

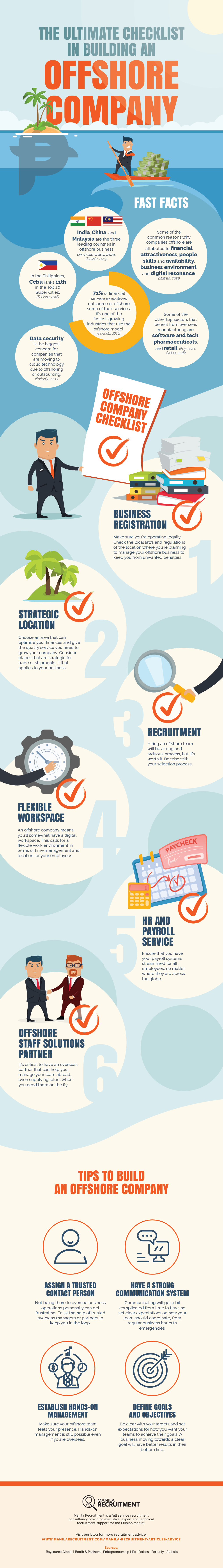

This is since the firm is signed up in a different territory that is commonly beyond the reach of tax authorities or rivals. If you are in the United States, yet register the company in a jurisdiction like Seychelles or Belize, you can relax guaranteed that your data is safe and secure.You will certainly not be subjected to the very same tax obligation prices as residential business, so you can save a terrific deal on taxes. The jurisdictions where overseas companies are generally signed up commonly have double taxes treaties with other nations.

An overseas company is also extra flexible concerning policies and also compliance. The regulations in the territory where you sign up the business might be less inflexible than those in your home nation, making it much easier to set up the firm as well as run it without too much documentation or legal hassle. You will certainly additionally have extra advantages, such as utilizing the firm for worldwide profession.

This is since the firm is registered in a territory that may have a lot more adaptable possession defense laws than those of your residence country. For circumstances, if you pick the right jurisdiction, financial institutions can not easily take or freeze your abroad assets. This guarantees that any cash you have actually bought the company is risk-free and secure.

The 6-Minute Rule for Offshore Company Management

Offshore companies can be used as cars to shield your assets against possible plaintiffs or lenders. This indicates that when you die, your beneficiaries will inherit the assets without disturbance from creditors. However, it is very important to consult a lawyer prior to establishing an offshore firm to make certain that your possessions are appropriately protected.Offshore jurisdictions generally have easier demands, making finishing the enrollment process and also running your organization in no time a wind. Furthermore, a number of these territories provide online unification solutions that make it a lot more convenient to sign up a business. With this, you can promptly open a business financial institution account in the jurisdiction where your firm is signed up.

Moreover, you can easily move funds from one savings account to an additional, making it simpler to take care of and relocate money around. When running a service, the threat of legal actions is constantly existing. Setting up an overseas firm can assist lower the chances of being taken legal action against. This is because the regulations in many jurisdictions do not enable foreign business to be filed a claim against in their courts unless they have a physical visibility in the country.

Not known Incorrect Statements About Offshore Company Management

Establishing a firm in one more nation can be rather easy. There are several nations that offer advantages to services that are seeking to establish an overseas entity. Some of the benefits of an offshore firm include tax obligation benefits, personal privacy and discretion, lawful protection and also possession protection. In this blog site we will certainly check out what an offshore firm is, puts to take into consideration for maximum tax benefits as well as also overseas incorporation as well as established up.

Numerous countries use tax obligation advantages to firms from various other countries that relocate to or are included within the territory. Firms that are formed in these overseas jurisdictions are non-resident since they do not perform any type of monetary deals within their boundaries and are owned by a non-resident. If you wish to establish an overseas company, you ought to utilize a consolidation representative, to make certain the documentation is finished correctly and you get the very best advice.

Check with your development agent, to guarantee you do not break any restrictions in the nation you are forming the firm in around secured business names. Consider the kinds of shares the business will certainly issue.

Get This Report on Offshore Company Management

Offshore business structures may hold an unique standing that makes them non reliant neighborhood domestic taxes or are called for to pay taxes on their around the world earnings, capital gains or income tax. offshore company management. If your offshore business is importing or exporting within an overseas location, for instance, receiving orders directly from the client and also the acquired items being sent from the maker.

For UK citizens, gave no quantities are remitted to the United Kingdom, the funding as well as earnings gained by the overseas firm continue to be tax-free. Tax obligation obligations typically are figured out by the nation where you have irreversible residency in and also as beneficial proprietors of a company you would be reliant be exhausted in your country of residence - offshore company management.

Tax obligations vary greatly from country to country so its vital to make certain what your tax obligation obligations are prior to selecting a jurisdiction. Offshore companies are only based on UK tax on their revenues developing in the UK. Even UK source returns paid to an overseas company should be without tax.

Report this wiki page